Learning how to save, eleven years later

I’ve been writing these annual reports for 11 years, starting in 2006. But if you only looked at a graph of my investment contributions over the same time period, you might assume that I’ve only been really serious about saving during the last 4 years. And there might be some truth to that.

The trigger for the change, counterintuitive as it may seem, was Stephanie quitting her job in 2014. My reaction to this voluntary reduction of our collective income, coupled with an indeterminate timeline (at first we thought 8 months—but if Stephanie completes her graduate program as planned, it will end up being 8 years!), was to impose a savings-based austerity program on my income. I increased my 401(k) contributions, funded both of our Roth IRAs (through “the backdoor”), and invested “The Rest” (essentially an arbitrary round number that I pulled out of a hat) in my brokerage account—starting in 2014 and continuing every year since.

“The Rest”

It wasn’t until 2016 that I started wondering exactly how much was “The Rest” with any precision. Money always flowed into and out of our checking accounts, but I didn’t know how much was surplus, versus how much was the slush we’d need to cover more expensive months in the future. This left me unsure about how much was safe to invest in my brokerage account for the long-term.

In theory, the formula for “The Rest” (for any given year) is simple:

Income − Taxes − Expenses − 401(k)/IRA Contributions = “The Rest”

But in practice, of the 4 variables, at the time I could only put a reliable figure on 401(k)/IRA Contributions because of their fixed maximums. Figuring out Income, Taxes, and Expenses ended up becoming eye-opening projects in their own right.

Sure I have a salary, but that’s not the same as Income. I have to account for mid-year salary adjustments due to merit raises or promotions, variable bonuses, the ESPP discounts, and stock offerings. Taxes are also a challenge, because I don’t know my Federal and State taxes until I file several months into following year. There’s also Social Security, Medicare, and California Disability Insurance (all of which can be determined by simple formulas—or by looking at the last pay stub for the year).

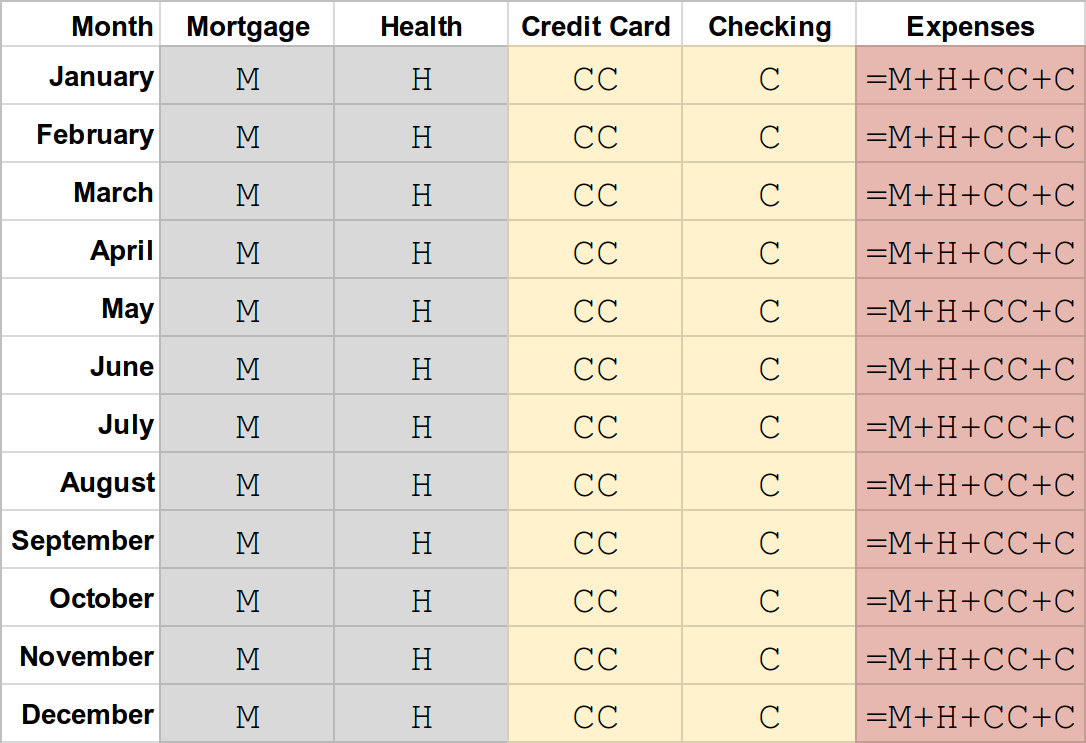

Capturing our Expenses took the most work, and turned out to be the most eye-opening. I started by recording our account-by-account outflow on a monthly basis in a spreadsheet. On the surface it looks simple, but each column required further analysis to compute (often in a separate worksheet) which I explain below.

Mortgage (or Rent) – This includes our monthly mortgage payment (principal and interest), our property tax for the year (divided by 12), our monthly HOA dues, our homeowner’s insurance (divided by 12), our life insurance premiums (divided by 12), a buffer for unplanned maintenance, and tax prep (divided by 12). Once calculated, I used the same value for each month of the year, regardless of the fact that some bills were paid annually and some biannually. Since we sold our condo, now this is just our rent.

Health – This includes my pre-tax contribution to our medical, dental, and vision insurance (from my biweekly paystub—times 26 divided by 12) plus my HSA contribution (which is the annual maximum, minus the portion my employer contributes, divided by 12). Again, like the mortgage, the value is the same for every month of the year. Though our HSA contribution is a form of savings, I haven’t completely bought into using it as an almost-perfect, tax-sheltered investment account. Plus we had a few medically expensive years, so we’ve used the HSA to reimburse ourselves for those expenses that hit our high deductible (or weren’t covered at all), and thus we haven’t built up a balance.

Credit Cards and Checking Accounts – In our case we both have personal credit cards, we share one joint credit card, and we both have personal checking accounts. So there are 5 columns of values to enter at the end of each month. However, we cannot just take the values from our statements verbatim. Some massaging is required to avoid double counting. We only use our checking accounts for infrequent ATM cash withdrawals and the even rarer payment by check—the vast majority of expenses hit our credit cards—so it’s pretty easy to sum up the 3-5 relevant debits. Interest is so minuscule, I don’t bother accounting for that. And of course we leave out the credit card and mortgage/rent payments, as those are captured in other columns. Annoyingly credit card billing cycles don’t align with the calendar month, so I just associate the statement with the month it encapsulates the most of. Then I remove any medical expenses that I plan to reimburse from our HSA (even if many months in the future), because those expenses are already (or will be) captured in the Health column. I also remove any work-related expenses for which I’ll later be reimbursed. It sounds like a lot of work, but it only takes a few minutes each month when I pay our credit card bills—always in full!

Expenses – Knowing how much we’ve spent in a month is then just a case of summing the columns: Mortgage + Health + Credit Cards + Checking Accounts. And after 12 months of entering expenses from our accounts, I can sum the Expenses value for each month, and complete the formula above to unequivocally determine “The Rest” for the year (after filing our taxes). At that point, I move money into my brokerage account to true-up the contribution for the prior year, or in the rare case that I over-contributed, I “virtually” carry the excess forward into the current year’s contribution (on the spreadsheet that sits behind the graph at the top).

Eyes Opened

I started logging our expenses by account in September 2016, filling in values all the way back to January 2015. There was nothing I could change about 2015, it served simply as a point of comparison for 2016. And 2016 was already 2/3rds of the way through when I started paying closer attention, so I wasn’t expecting the scrutiny to have any meaningful impact on our lifestyle—besides knowing definitively how much to move into my brokerage account. But I was surprised at how eerily similar 2017 was trending to 2015 and 2016. On the plus side, we were keeping our expenses relatively constant year-over-year, resisting lifestyle inflation even as my salary crept up and Stephanie’s tuition increased significantly (after transferring from CCSF to SFSU). But still, there was that number, that exorbitant sum of 12 months of expenses, remaining so consistent over the last 3 years.

Remarkably, it wasn’t until 2016 that I first learned about the vaunted “4% Rule”—stating that one should aim to save (and have invested) 25 times their cost of living to be financially independent. On Jan 1, 2015 our investments were worth a hair over 1X our cost of living that year—most of which was locked away in Roth IRAs that we couldn’t (or shouldn’t) touch for 25 years. At the start of 2017, our investments had grown to 2.5X our cost of living. By investing the equity previously locked in the walls of our condo while also reducing our cost of living (well, at least the housing part), we started 2018 with investments at a market value of 12.5X my estimate of our cost of living for this year!

What’s Next?

That’s the question I keep asking myself. This year Stephanie will finish her bachelor’s degree 🎓 and the prerequisites for grad school 🎉. In the fall she’ll apply to grad schools—which is when things start to get interesting. She hasn’t decided yet where she’ll be applying, and even then, we won’t know until the following spring (of 2019) where she’ll get accepted—and whether a change of scenery will be in our cards. Otherwise, this year should be like the last, with the exception that we’ll be renting instead of owning (and investing the difference).

Update: Learning how to save, twelve (point seven five) years later

Lovely, so your opinion is that you should sell the house in invest elsewhere, I always tell my wife that, but she do not believe. Poor me.