Learning how to save, eighteen years later

With one notable exception, our savings strategy in 2024 was identical to the year prior: max out our pre-tax retirement plans at work, i.e., Stephanie’s 403(b) and my Individual 401(k), and max out our traditional IRAs—if allowable. And allowable it was, because our modified AGI was below the “phase-out threshold for MFJs covered by retirement plans at work” ($123,000 in 2024), and our AGI was below that threshold precisely because we had maxed out our pre-tax retirement plans at work. Put simply, our 401(k) plus 403(b) contributions reduced our taxable income to the point where we could also make traditional IRA contributions, which further reduced our taxable income. All together these retirement contributions saved over $13,000 in state and federal income taxes.

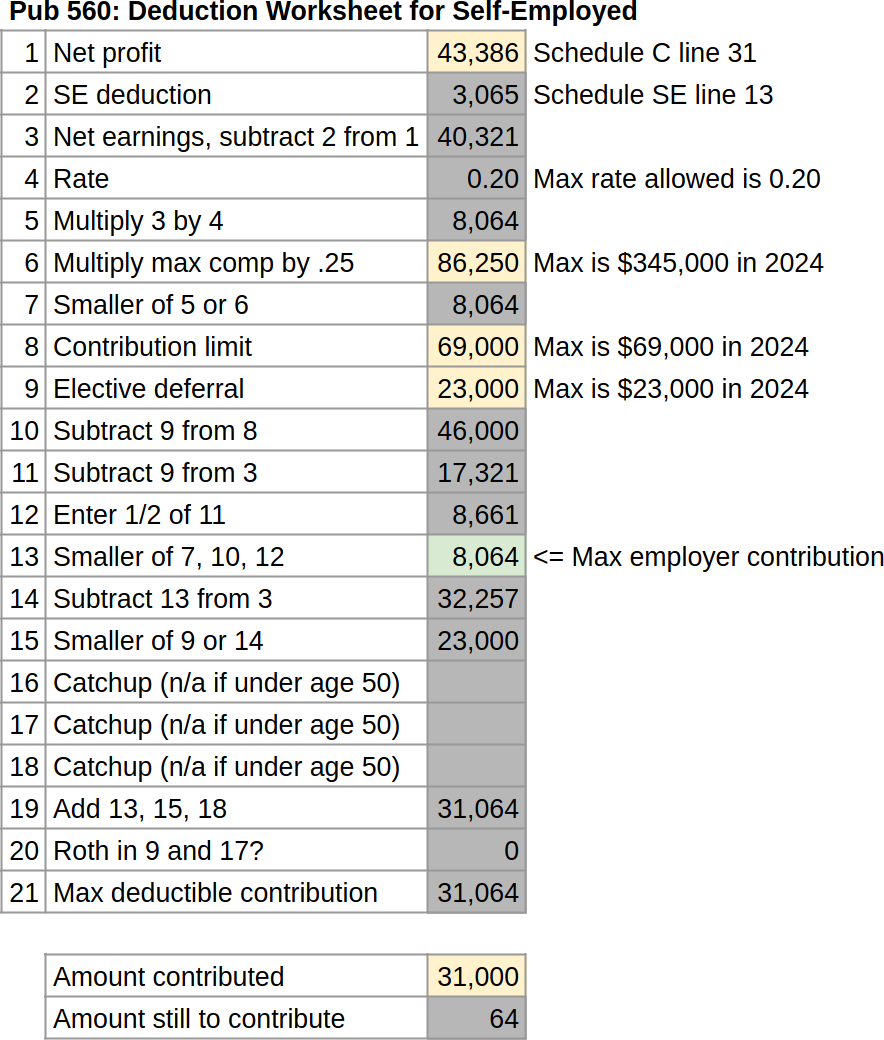

And the one exception? I earned enough net profit from self-employment in 2024 to make an employer contribution to my Individual 401(k). One of the quirks of self-employment is that I function as both an employee and an employer, and as the latter, I can choose to share a portion of the net profit with my Individual 401(k), on top of my employee contribution. To better understand the rules for calculating the maximum allowable employer contribution, I implemented the IRS Pub 560 “Deduction Worksheet for Self-Employed” within my trusty tax simulator spreadsheet. (Check out Go Curry Cracker’s excellent Solo 401(k) Contribution Calculator for a user-friendly and interactive version of the same.)

In short, the worksheet calculated that I could make an employer contribution up to $8,064; I ultimately contributed a nice round $8,000. Given that the overall maximum 401(k) contribution in 2024 for those under age 50 was $69,000, the employer contribution could have been as high as $46,000, though one’s net profit would need to be nearly $244,000 to reach that threshold—not impossible for some self-employed high-earners, but an unlikely scenario in my case.

I don’t anticipate any big life changes in 2025, so in all likelihood this year will look substantially similar to the last—or it could be completely different. I’ll know more in a year.