Learning how to save, eight years later

Just before my birthday I got an email that contained a retirement factoid I’d never heard before:

Fidelity suggests that by age 35, you should have at least one times (1X) your yearly income saved to meet your basic needs in retirement.

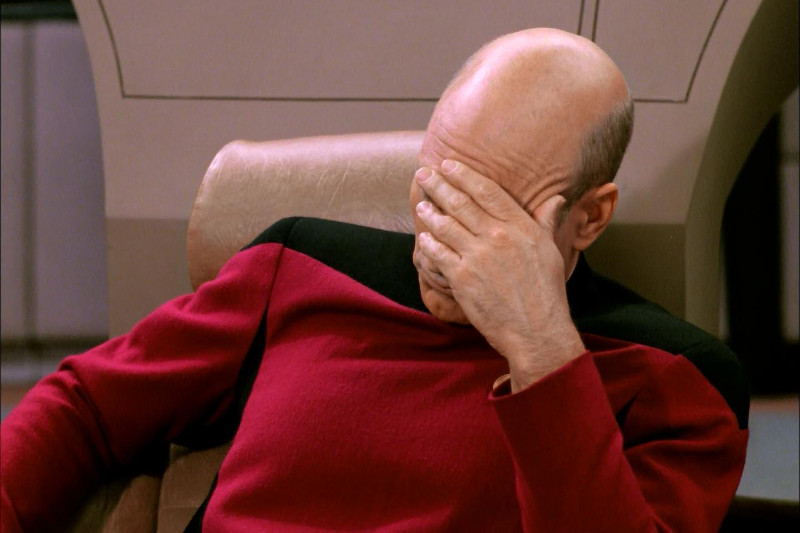

Nothing like a little extra retirement anxiety on my birthday. Thanks Fidelity!

Update: Don’t put too much stock in rules-of-thumb. A year later, Fidelity sent me an email that said:

Fidelity suggests that by age 35, you should have at least two times (2X) your yearly income saved to meet your basic needs in retirement.

It looks like they’re sticking with “2X by age 35”. Fidelity just produced a video with the following benchmarks:

Update: I’ve since learned that a far better indicator of retirement-readiness is aiming to reach a point where “your assets now equal 25-times your annual spending”. With Fidelity’s rule-of-thumb, age and salary are largely out of your control—and as your salary increases, counter-intuitively that pushes back the goalpost on retirement (because it assumes a proportional level of lifestyle inflation). Using savings and spending as the indicators puts financial independence squarely in your control. Want to retire before age 67? Reduce your spending and/or increase your saving.

But it did succeed in getting me thinking about how I measure up. If I combine both my Roth IRA and my 401(k), I’m a hair over 50% (or 0.5X) of my salary. If I also include my brokerage account (which isn’t strictly earmarked for retirement—it’s more medium-term savings), it bumps up to just over 60%. So by that yardstick, I’m coming up short. Their email obviously had the intended effect, because I increased my 401(k) contribution from 6% to 75% just in time for my final paycheck of 2014.