Why buy?

What with all the mortgage crisis and bank failure drama in the news lately, I started to get the buy-a-home-of-my-own feelings again. As I’ve told Stephanie, all I really want to do is rip out the kitchen and install an Instant Kitchen. (Home Depot summer camp for adults anyone?)

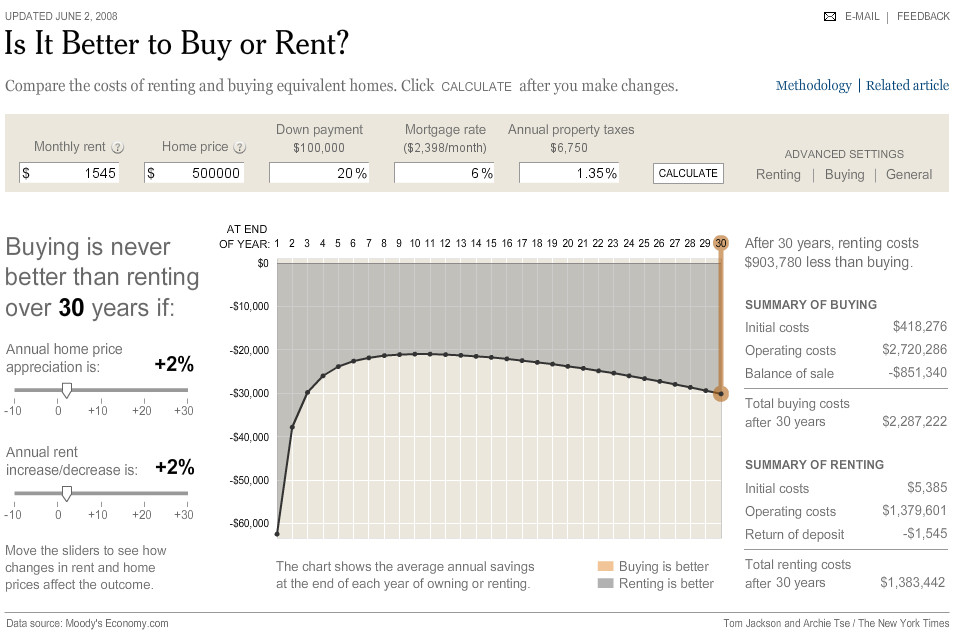

In order to get my head on straight I went back to the NY Times’ Is It Better to Buy or Rent? calculator. I like how it said (and continues to say) so unequivocally: Buying is never better than renting—assuming your rent is around $1500 and you’re looking at one bedroom condos in San Francisco, which start at $500k.

I mean maybe you could find something in the $400s, but it turns out that doesn’t help the picture much. Nor would it if our rent shot up to $2000—which our landlord let on is what they’re now renting the apartment above us for (two years in the city and rents have gone up $500…). No, owning doesn’t start to break even with renting until housing drops below 250k, something that will almost certainly never happen in San Francisco.

Which brings me back to where I started. Why buy?

Update: Perhaps this buy-a-home-of-my-own feeling is a cyclic thing. This post is a somewhat subconscious followup to one I wrote exactly a year ago: Thinking ahead (about real estate)

equity – paying mortgage is much more like investing than paying rent, which nets you 0.

tax benefits – pretty much all mortgage interest is tax deductable.

this chart doesn’t represent the whole picture. not only savings should be looked at but net worth too. your net worth increases as you pay off mortgage.

of course, I rent, so what do I really know.

I believe the chart takes all that into account. If you click on the graph, you’ll see a screenshot of the bigger interface, which shows the financial costs/benefits after 30 years. The one thing it doesn’t take into account is money saved while renting is money you can put into the bank and invest at X% (which I think makes renting an even more attractive option).

nate: that chart does take into account net worth and tax savings from mortage interest. It assumes that any savings from renting are invested, however. You can tweak the values of many assumptions, such as your return rate on investments.

Even if you don’t actually invest your savings from renting, calculating as if you would is a good way to calculate your opportunity cost from home buying (the lost opportunities to buy things now because you’re spending it on home ownership. ie, putting a dollar amount on the cost of eating ramen for a decade or two)

ok ok, it’s true, I didn’t click the chart before commenting. :)

justin: click on Advanced Settings/General. Not only do they take into account that money you save while renting can be invested, they let you tweak the percentage return you expect on your investments.

Very timely! I get the angst to own every so often, and I don’t even know why…in the long run, it may be more angst and stress than it’s worth even if you made a financial gain. Yet I can’t seem to get free of those feelings myself sometimes.

FWIW, I’ve noticed that a lot of people seem to be coming around to the same conclusions about car ownership that you’ve been developing for some time. I think the data you’re working with here is quite valuable for the same sort of decision making.

Maybe you should talk to your landlord about your kitchen remodel idea. I’ve found that they can be surprisingly agreeable to changes you’d like to make, and the worst they can probably do is say no, right?

Eric, yep I did. I set the condo fee/common charge (aka HOA) to $300, which is around what I’ve been seeing—and which ends up not having that substantial of an effect.

I pretty much left the investment rate alone. Gotta say 5% sounds great, as right now I’m at like -7%.

Terrie, the combination of living in the city + Zipcar + Vespa has really made carlessness possible. I rely on both pretty heavily, though when FM moves into San Francisco next month, I’m worried I may not need my scooter as much. :(

The hardest part of that equation (for both me and Stephanie) turns out to be “living in the city.” I can’t imagine not living here, but we end up missing the outdoors on a daily basis. We especially miss having a warm summer. I’m hoping that FM’s change of environs may elevate our city experience.

Now for a comment from a home owner. Hi everyone! I love my home. I get to change things to my taste, rip down walls, add energy and resource saving appliances, and make it look amazing. Home ownership is a long term investment and I know alot of people who have done very well for themselves in all types of markets. My father is a butcher and my mom is a school teacher. They now own a large custom home in an exclusive area, at the top of a hill, overlooking a wildlife preserve. They have lived through a variety of markets and soon their payments will be nil. I can certainly see why renting will allow for significant savings IF one has the discipline to put away thier money and not spend it. Not many out there do. Also, with the demand for renters increasing because of exotic mortgages landlords will begin to increase. How much will rent be when you retire? The best way to take advantage of a great home investment is to keep your payments no more that 30% or less of your gross monthly income. This way, there is plenty left to invest, contribute, and live. Oh ya, and be sure that is a 20 or 30 year fixed.

I can see what you’re saying here. I used to think the same way. The problem with charts like this is that it doesn’t apply to specific situations. Kyle and I, for example, both have freelance businesses that caused tons and tons of money to go to the government each year. Buying a house is the only deductible we have found to stop that from happening. On top of that, we bought a fixer-upper, meaning that it will appreciate a lot faster than other houses. Although I have other mixed feelings about buying a house, buying a house was a smart decision from a financial point of view, given our specific situation.

Also, money depreciates. Land generally doesn’t, at least not in the Bay Area. I mean, an investment can’t get much more brick and mortar than a house… ha. ha.

Two things, how do freelance businesses cause more money to go to the gov’t than non-freelance? Granted you pay the full social security and medicare taxes, where as an employee would pay half of it for you without you knowing, but it’s still getting paid.

Also, I’m not so sure about housing prices in the Bay Area not depreciating… Bay Area home prices plunge 27% in last year.

That said, I totally agree that monetary costs are not the only factor to weigh when thinking about buying property. There’s also things like mobility, a place to raise a family, community, friends, desire to do home improvement projects.

But honestly, I’ve come to wonder whether the drive to own is really a strong conservative urge in people to put money into a non-liquid asset. (This is not necessarily a bad thing.)

In general I’d guess that most people are unable (or unhappy) to save large sums of money in a savings or investment account without spending it frivolously. On the other hand, buying a house is a responsibility, and the money put into it is hard to take out. But the freaking interest man! Not to mention property taxes and insurance.

Unfortunately, self-employed people have to pay nearly half their income to the government. At least, that is what has been confirmed over and over again in our taxes. And yeah, home prices have plunged recently, but the market is cyclical, and over a longer timeline, there is huuuuge appreciation in the Bay Area housing market. Overall I think land is more stable and less likely to depreciate than say, stocks and bonds, but that’s just me. In terms of wealth, it’s good to have diverse investments, including tangibles like land and market investments like stock and IRAs and whatnot.

But one thing I agree with you on: when you are dealing with such an expensive housing market, you can end up screwing yourself by investing badly. We tried to look for the best investment for the kind of life we want to lead. We bought a place with a higher appreciation than average to ensure a better investment (a fixer-upper). We bought a big lot (more land=better value) in the best part of town (location) to further ensure appreciation. There are no new houses being built around us, the houses around us are all worth $700,000-in the millions, and the town is generally becoming a more desirable place to live in–this all bodes well for us as an investment. We also really worked at getting a good deal by pitting two mortgage brokers against each other during escrow. As a result, we have a lower interest rate than most for the time we bought in. So it’s a matter of shopping around and thinking about what is likely to be the most desirable place to live in 10 (or 20 or 30) years from now.

What *I* don’t like is the pressure to get a house: The societal expectation that that’s something you should want, or else something is wrong with you. I like owning a house, but I thought it was kind of lame that people expected me to want that as a major goal in my life. It was, sort of, but not in the 2.5 kids, minivan kind of way.

Every situation is different and everyone has their own reasons for choosing one over the other. I agree with Joy. I don’t like the social pressure and there is also social pressure to max out your mortgage. Bad idea. I love it that you are who you are and you are choosing your own path as we all should. We didn’t buy until after 9 years of marrige and 10 years of togetherness. We did what we wanted with our money instead of jumping in to a large purchase. We enjoyed each other and honestly early on we didnt want to buy either. Enjoy each other and enjoy every moment where you want to be. Knowing you, you will be set no matter what because you do have that discipline to save that liquid. So when are you coming to Tahoe next?