Hamburgers are cheaper

I recently stumbled upon another great Warren Buffett excerpt from the 1997 Berkshire Hathaway Chairman’s Letter:

A short quiz: If you plan to eat hamburgers throughout your life and are not a cattle producer, should you wish for higher or lower prices for beef? Likewise, if you are going to buy a car from time to time but are not an auto manufacturer, should you prefer higher or lower car prices? These questions, of course, answer themselves.

But now for the final exam: If you expect to be a net saver during the next five years, should you hope for a higher or lower stock market during that period? Many investors get this one wrong. Even though they are going to be net buyers of stocks for many years to come, they are elated when stock prices rise and depressed when they fall. In effect, they rejoice because prices have risen for the “hamburgers” they will soon be buying. This reaction makes no sense. Only those who will be sellers of equities in the near future should be happy at seeing stocks rise. Prospective purchasers should much prefer sinking prices.

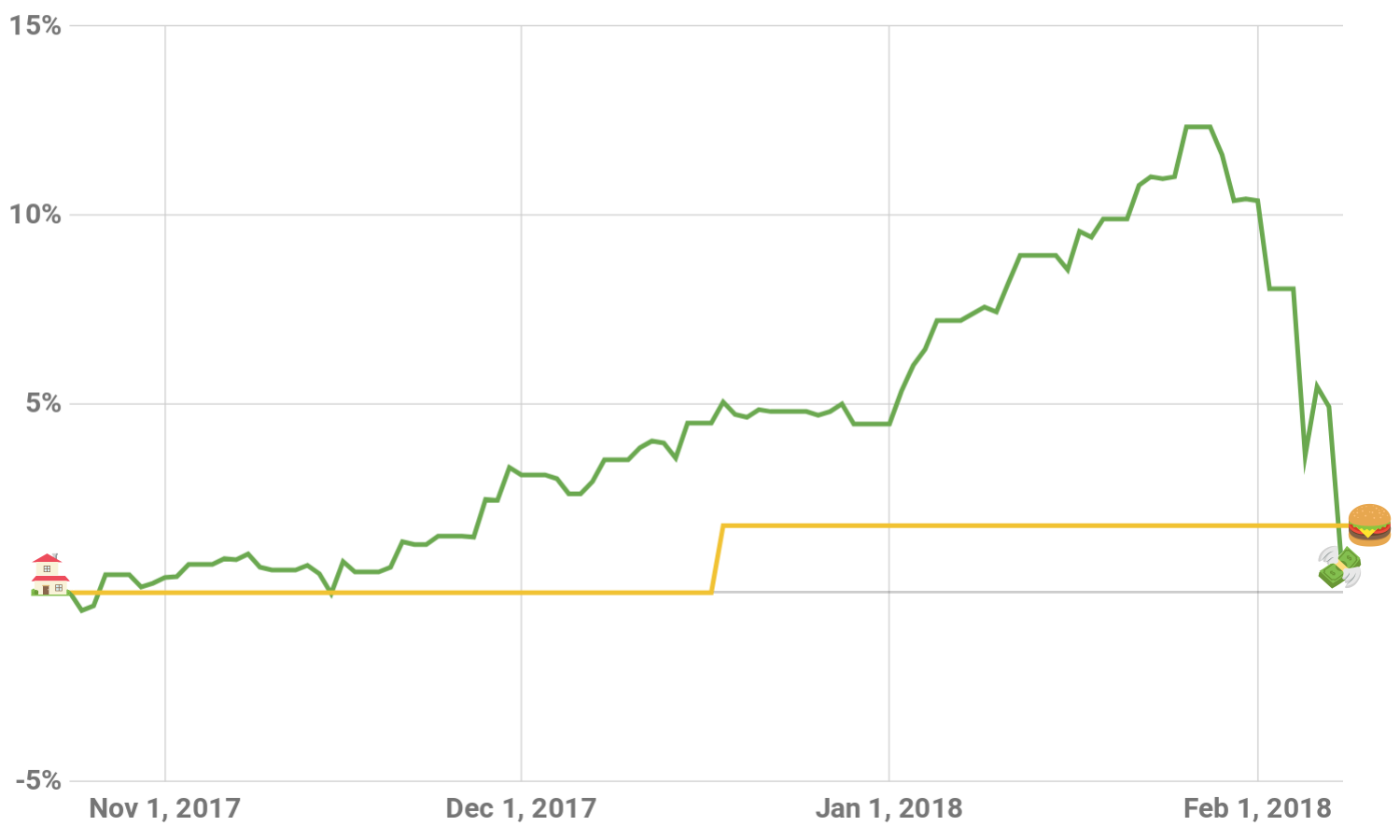

When we sold our condo last October, I invested 100% of the proceeds in Schwab’s S&P 500 index fund (SWPPX). It was pretty exhilarating to watch it climb in value practically every day, all the way through January 26th, at which point it had increased by 12.3% in only 3 short months. Since then, it’s been no less exhilarating to watch it drop precipitously in value, essentially retreating back from whence it came, in only 2 short weeks. This seemed like the perfect opportunity to contrast the volatility of value against the stability of ownership. Though the market has risen and fallen dramatically over the last 4 months, I still own the same number shares—in fact I actually own almost 2% more than I started with, because I reinvested the dividends and capital gains that were paid out in mid-December.