Learning how to save, ten years later

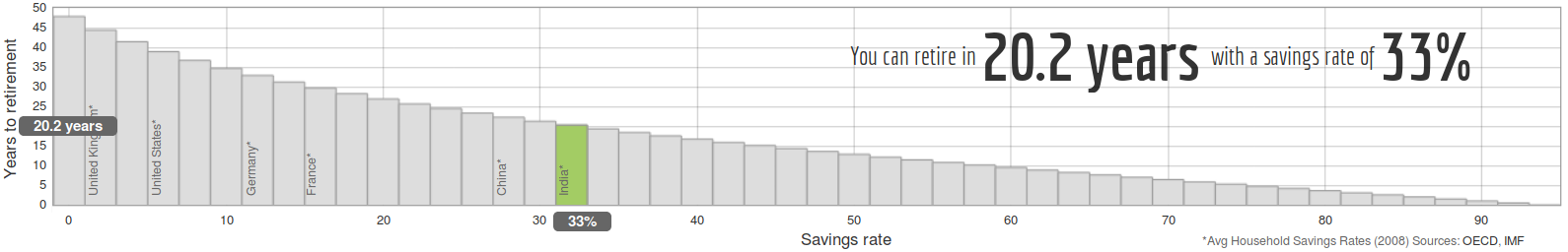

Last year I started tracking all of our monthly expenses against our income to put a number on how much we had leftover to save. Considering that we’ve tried to curb unnecessary and excessive spending since Stephanie quit her job in 2014 and went back to school in 2015, I was still shocked to discover our total cost of living at the end of 2016. After taxes, 29% goes to the mortgage and related expenses while another 38% supports our lifestyle, which leaves 33% to save. We are fortunate to be able to save a third of our net income for retirement—a rate I’ve deliberately worked to increase over the last 3 years—but when measured against the “financial independence” yardstick, not-so-early retirement sits over 20 years away. Update: I revised the percentages and the graph below using more accurate values available after I did our taxes—and it shaved 3 years off of my working life.

That said, early retirement is not my goal. I’m not sure what my goal is. Periodic retirement? Work hard for a handful of years, step away, and then return—unconstrained by prior comforts, habits, and expectations. When viewed from that perspective, those unfathomable 20 years start to look more attractive: a series of several jobs (seeking that ever-elusive purpose), punctuated by sabbaticals of adventure and self-discovery.

But enough navel-gazing. Let’s get down to brass tacks. In 2016 I:

- Refinanced our mortgage (for the second time) in April to fund a home improvement project

that still hasn’t started (but that’s another story)

Update: here’s the story: Dining Nook Renovations - Contributed to our Roth IRAs for 2015 on tax day (via the “backdoor”); did the same for 2016 in November

- Sold the international index funds we held across our accounts (after several years of poor performance) and purchased more S&P 500 index fund shares in their place

- Switched my 401(k) contribution from Roth (post-tax) to traditional (pre-tax)

- Continued contributing to the FTD ESPP and sold my shares as soon as I was able

- Shifted the money in our “emergency” savings account (what remained after buying La Jeep) to my brokerage account

In 2017 I plan to:

- Max out my traditional 401(k)

- Max out our Roth IRAs (via the “backdoor”)

- Max out our HSA

- Continue working to minimize our expenses in order to maximize what’s leftover to invest in my brokerage account

- File our 2016 taxes myself (with the help of TurboTax)